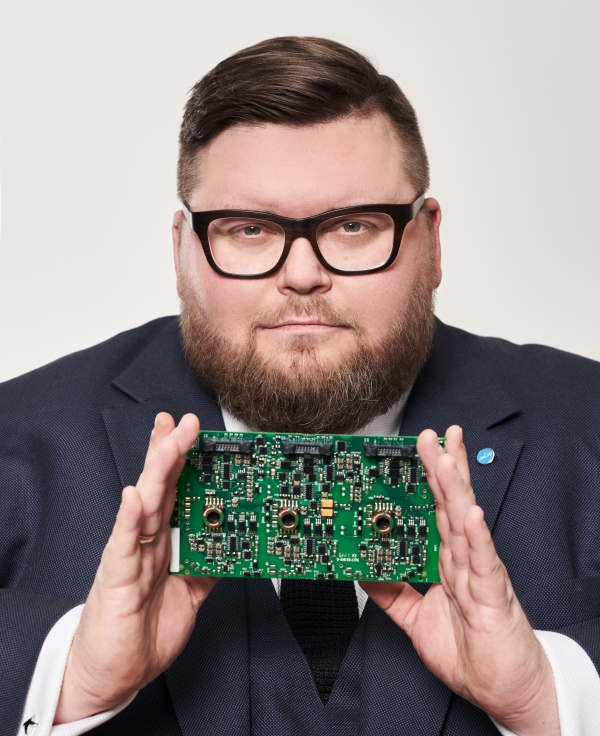

Incap Corporation’s President and CEO Otto Pukk

Incap Corporation’s President and CEO Otto Pukk

2025 was a year where Incap’s business progressed largely in line with expectations, and I am pleased to say that we delivered on the estimates updated halfway through the year. The market environment continued to be shaped by uncertainty and geopolitical challenges, but we have become accustomed to operating in this “new normal”. Despite these external shifts, we remained focused and moved forward with confidence. I would like to thank our entire team for their dedication and professionalism throughout the year – your work has enabled us to stay resilient and agile.

Our revenue for 2025 amounted to EUR 214.6 million, with the fourth quarter contributing EUR 55.3 million. On full year level, the exchange rates had a negative impact of EUR -6.6 million on our revenue. Our operating profit (EBIT) for the full year was EUR 25.3 million, or 11.8% of revenue, while in line with last year’s level. These figures demonstrate the strength of our operational model and the consistent execution across our units.

A major milestone in 2025 was the acquisition of Lacon Group, which was completed in February 2026. This acquisition strengthens our position in the fast‑growing defence sector and significantly expands our design and development offering. Together, we form a stronger, more competitive, and more capable group – empowered by our decentralized organizational model and global sourcing expertise. By uniting our engineering strengths, we can offer customers a broader range of services and deliver more comprehensive solutions that enhance our value proposition across the product lifecycle. We are excited to welcome Lacon’s management and employees to Incap’s team.

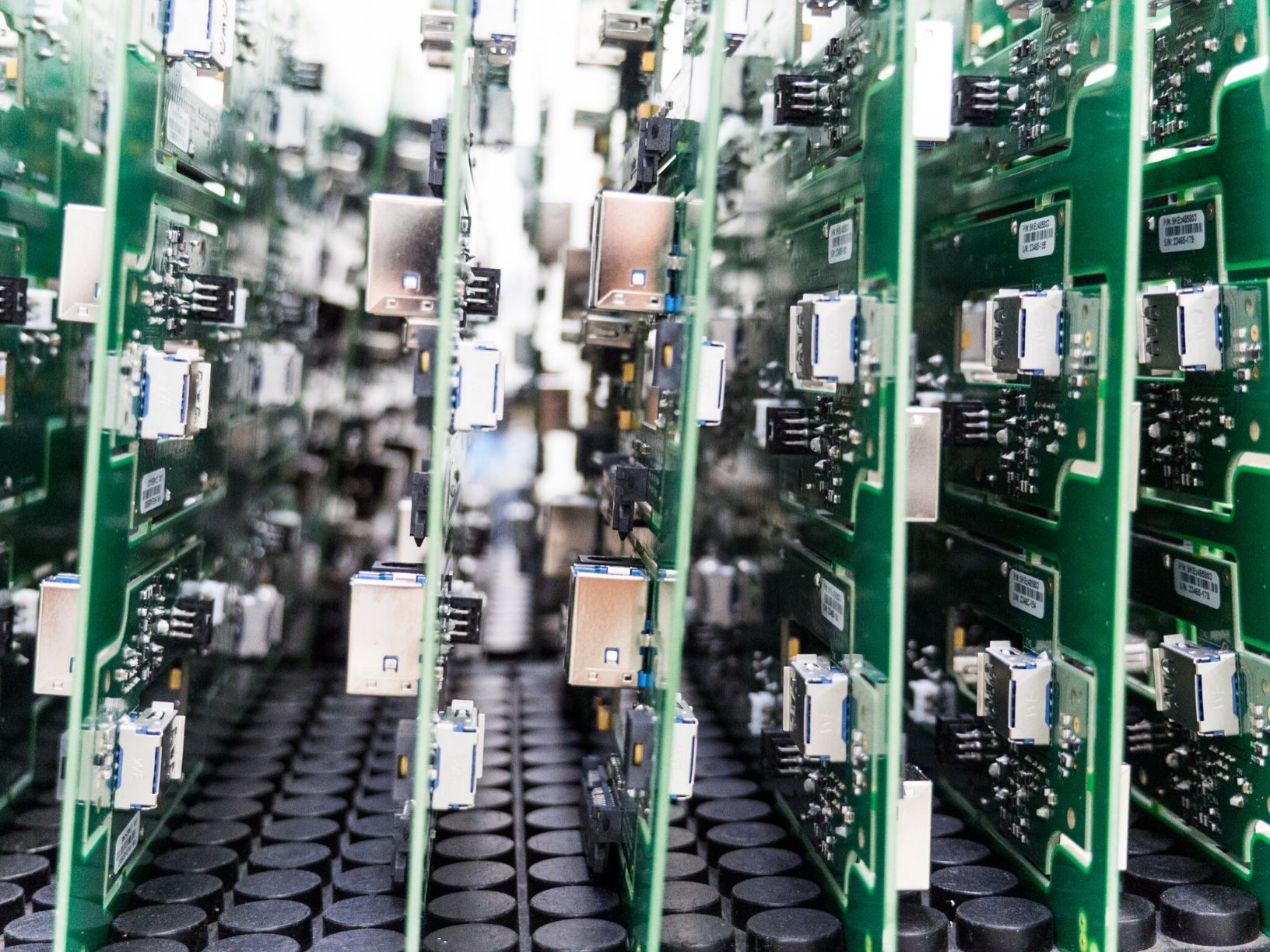

Throughout our global operations, we continued to invest in technology, capacity and the long‑term competitiveness of our units. In India, we upgraded our SMT capabilities and invested in a new flying probe test system, while our teams in the US and UK also strengthened production with new SMT equipment. Slovakia reached an important digitalisation milestone with the rollout of a new ERP and MES platform and upgraded its PCBA washing technology, and in Estonia we improved our quality control capabilities with a new flying probe and X‑ray inspection system. These investments ensure that our factories remain modern, efficient, and well‑equipped to support future growth.

At the same time, we continued to advance our sustainability work. One of the year’s most meaningful steps was taken in the United States, where we decided to invest in an on‑site solar power plant, supported by federal clean‑energy incentives, aiming for a full transition to renewable electricity at Incap US. In the UK, rooftop solar panels were installed, expected to supply nearly half of the unit’s electricity, and in India the solar capacity at our newest factory was put into operation. We continued strengthening our Group‑wide environmental and safety work through audits, new ISO certifications, and the completion of our annual review of Double Materiality Assessment. We also developed our Climate Transition Plan, outlining clear targets for reducing emissions across our operations and value chain. Even with less regulation, we remain committed to sustainable business principles and will continue treating sustainability as an essential factor in how we operate.

2025 was also Incap’s 40th‑anniversary jubilee year, devoted to strengthening future talent and community impact by backing youth skills and robotics initiatives, fostering career pathways, and partnering with cultural events, ensuring our growth remains responsible and rooted in the regions we serve.

As the Lacon acquisition was closed, our main focus is on integrating Lacon smoothly into Incap and building on the strengths and opportunities this combination creates. While the integration work is ongoing, our priority is to strengthen our joint capabilities before further acquisitions.

We expect the market environment to remain uncertain, but we remain optimistic about the future. With our strengthened engineering offering and new potential in high-growth sectors, we are well‑positioned to continue executing our long‑term strategy and generating value for our shareholders.