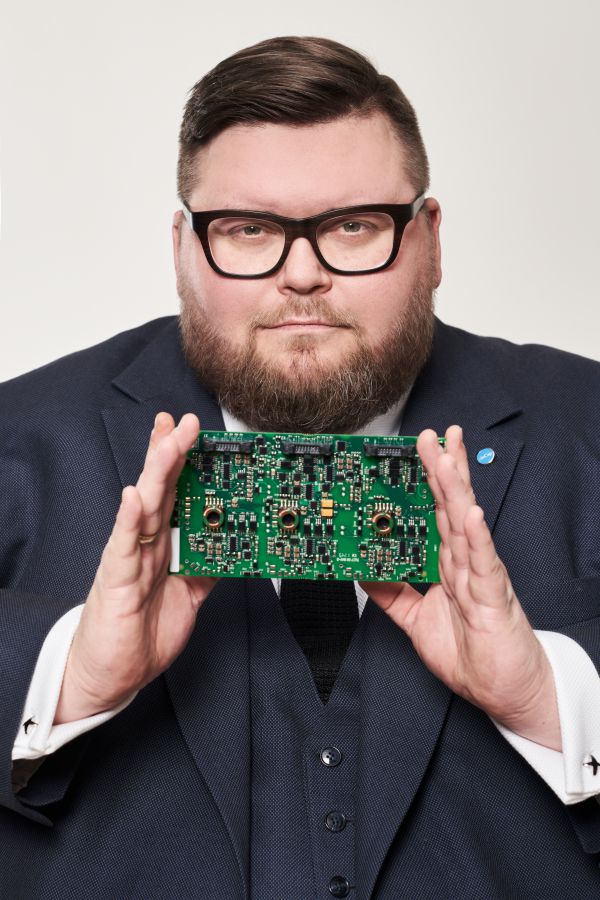

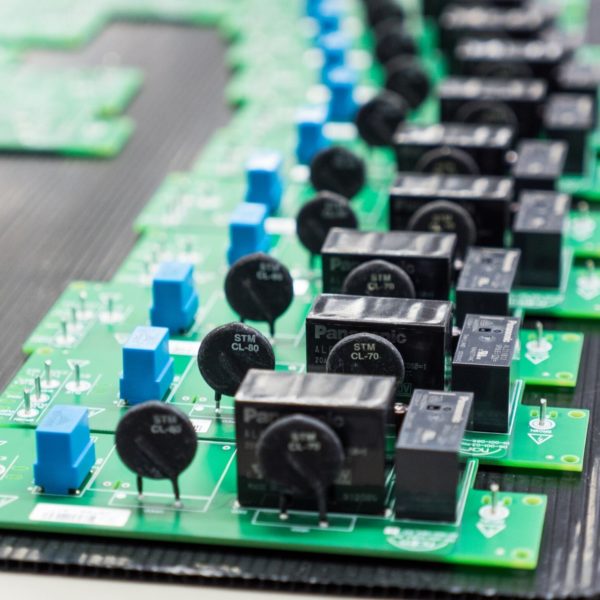

In the past few years, Incap has grown quickly and profitably. The growth of our company is supported by the increased utilisation of electronics and by global outsourcing trends. Our unique entrepreneurial culture and effective operations are the basis of our good profitability.

Our growth history is strong and we have continued our growth also in 2020 on the basis of the strategically significant acquisition of AWS Electronics Group finalized in January this year. The acquisition gave us a strong foothold in certain markets, particularly those of Great Britain and Central Europe, and strengthened our position in the US and Southeast Asian markets.