Incap H1 2025: Questions and answers

INCAP H1 2025 webcast on 25 July 2025 at 11:00 a.m.

Q: Do you see a lot of pent-up demand due to the postponements done by the customers?

A: I want to emphasize that the main reason for us to change the steering was the exchange rates and not the postponements of projects. The postponement of projects is more reflecting that we were expecting growth in Q2. There is still hesitation especially with our customers that deliver into US or have end-customers delivering to US. We see that in many sectors, both industrial but also defence. Customers said there have been some question marks regarding projects in support of Ukraine from the US, and those are now pushed in the future. It is not a question of disappeared demand but a question of timing. We are already in the second half of the year and very close to the window where we already know how the year will play out and if the orders haven’t been placed by now then there is not a big probability that they will be fitted into and delivered this year. Of course, the longer it takes, the more likely it is that orders will be delivered next year rather than this year.

Q: What is your current utilization rate and what is your revenue run rate at full capacity?

A: Full capacity is a relative term as we always plan to have some over-capacity. We have that today as well, and that is what we are selling for our customers and for our potential growth. Capacity depends on what kind of product mix there is. So, I wouldn’t talk about capacity, it’s an old way to look at manufacturing as capacity utilisation is a moving target. As an EMS company, we can always rent more facilities, we can rent equipment, we can rent people. It’s more a question of what the customer needs and what is the current output we have and then we will match it. It’s the matching that need that is the core and essence of EMS business nowadays.

We have capacity available, which means that we don’t need to invest necessarily in floor space or real estate. In theory we could add more capacity, when working in one shift, we would add in a second or even all three shifts, i.e. working around the clock. We don’t need to invest in real estate or floor space and not that much on machinery and equipment either to meet the growing demands from our customers.

Q: How has your largest customer been developing relative to the rest of your customers in H1?

A: I think they have been developing good. We have slightly increased the volumes and during the quarter we were producing steadily for them, but they are also one of the customers who deal in US dollars. Even if we have increased slightly volumes, when we convert this into Euros, the value is slightly less than it was say a quarter or two ago because of the US dollar exchange rate.

When we do the full year forecast internally, we do a lot of different scenarios with different exchange rate as well. The main driver is always the customer demand, their outlook, their confirmed orders, and agreed production plans. We put all these numbers together and we do scenario analysis several times a month and go through the plans with all the MDs in the meetings. With the exchange rates on average for January-June, this is currently the best estimation of the business. We aim for shooting on the higher boundary of the range, that is our ambition level internally. We are in July and there is obviously still a lot of work to do to meet those figures, but we will keep you all posted on the progress.

Q: Is defence a big market for Incap or Incap’s customers and would you like it to be bigger considering how the defence market is developing currently?

A: Defence currently is not too big, slightly less than 5% of our total business is related to defence and aerospace as we bundle those in one segment. We have been working on increasing it over the past year and we’re looking to continue that work. It’s also a volatile market and it is good days now for the defence business but there are also downsides in it when it goes downwards. We won’t focus only on the defence business. It’s a part of a balanced customer portfolio and we aim to be involved in many sectors. It’s currently attractive and there’s a lot of money moving there. We’re also working very close with several customers and several projects on the defence side, and we’ll continue to do that.

Q: The financial expenses were increasing. What is the trend for debt related expenses going forward?

A: The interest that Incap is paying is actually going down. Interest rates (Euribor) and Incap’s interest premium with the local bank is going down. Incap paid EUR 150,000 less for debt in the first six months this year compared to last year. The majority of the financial expenses are actually related to the translation differences. We are a very international business, and we have a lot of US dollar-based assets. There are US dollar-based bank accounts in parent company and in the US, and there is a EUR 20 million intragroup loan between Finland and Incap US. All of these are valued in the end of the month with the latest currency rates, and that explains the growth on the financial expenses side. Incap has also monitored the development of the currencies and analysed different ways to protect against the changes. For example, we have hedged at the end of last year the intra group receivable from US and that is on the other hand showing some financial income on the P&L.

Q: Do you have benefit of the US dollar situation in your purchases?

A: India, which is the biggest unit, or in the US and we also purchase very much in US dollars, which offsets it a little. I want to emphasize that foreign exchange impacts are only on paper, as we are not in the reality converting the US dollars to Euros. In reality, we haven’t got any hit by it. If we would pay dividend and actually repatriate the cash, that would have an actual impact. It is not a dramatic situation, as we will continue to trade in US dollars also in the future as well.

Q: Where are the majority of your customers’ customers and what are their end markets?

A: The majority of our customers are based in Europe, but their customers can be all over the world, and therefore it is hard to say. Even if many of our customers are European companies, we can deal with their subsidiaries in in different parts of the world. And, in the US, we are dealing with companies whose customers are US based and have a big business within the US. The same goes for the other units.

Q: What items impacted the second quarter EPS figure?

A: In the second quarter we collected from our Indian subsidiary quite a substantial intra group dividend. We typically repatriate funds through a transfer pricing mechanism and that’s the prioritised method. But especially now when the cash levels were growing strong in India, there was a decision to repatriate funds in the form of internal dividend to the parent company. There was a withholding tax related to this, and we ended up paying two and a half million of intra group dividend withholding tax in India and that obviously impacted a lot the second quarter result. But I would consider that as a non-recurring item by nature. The parent company is responsible, for example, for all the major strategic initiatives and therefore, the cash needs to be in Finland if Incap is pursuing, for instance, acquisitions.

Q: How do you evaluate internal reinvestment opportunities versus returning capital to the shareholders and how do you prioritise between organic growth and further M&A opportunities?

A: I strongly believe, based on my studies, that if you don’t have any depreciation on machines, you have invested too late in your production infrastructure. There’s always a machine cost in the equation and result. You need to keep on investing in the equipment and the latest technology and there is no way to have zero depreciation. It would cost you more or in the long run, so investing into your own manufacturing is a hygiene thing.

You can always argue that if we have a totally new business opportunity and we need to invest say in a new factory compared to an acquisition, then those are bit more comparable opportunities. Opportunities with existing customers and growing organically with existing customers, is always preferable compared to growing through acquisitions. You need to evaluate also if they are comparable opportunities, the investment and the acquisition, or is the investment a hygiene thing.

Q: What is your strategy to avoid commoditization in the EMS industry?

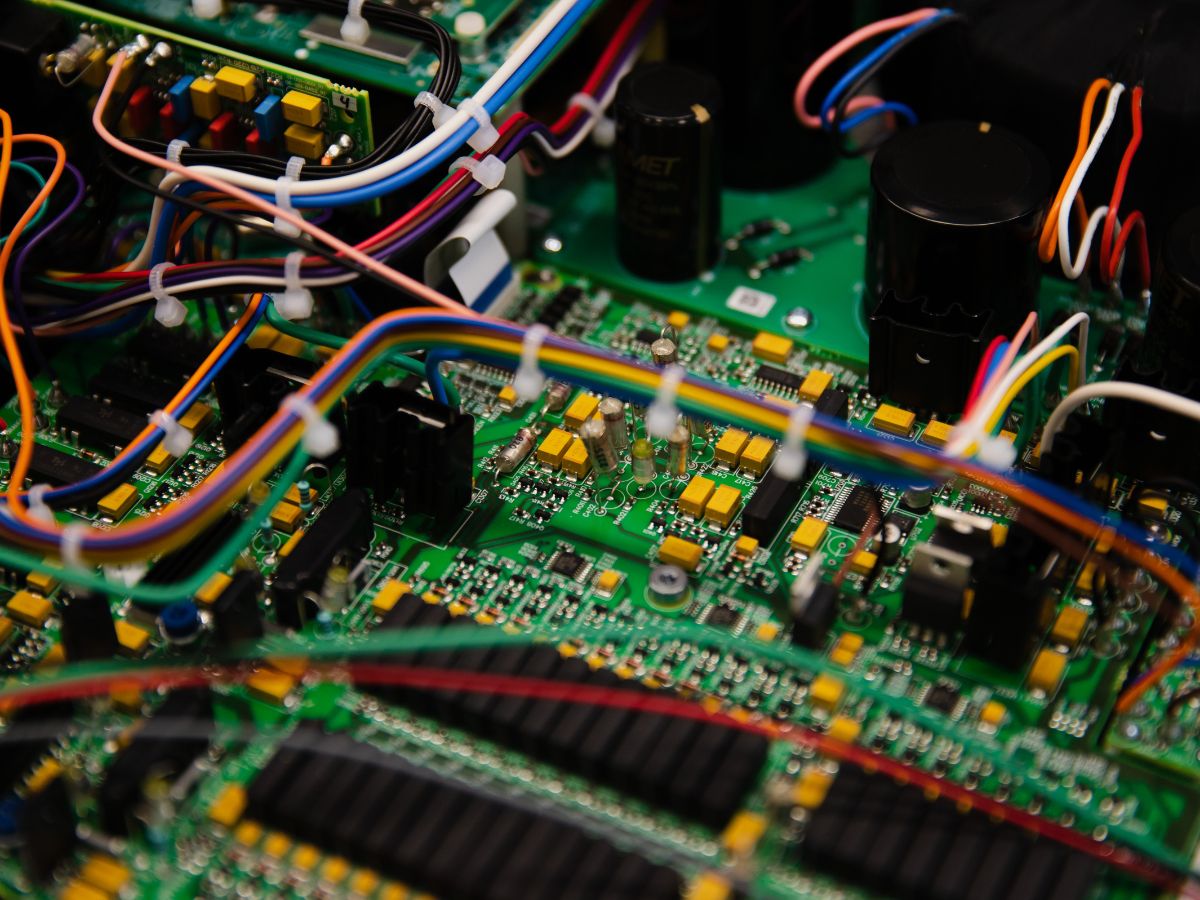

A: It is not clear what the question means, but maybe you do strategy to avoid commoditization in the EMS industry. There are often discussions about different segments in our industry and, I’ve seen many of our peers to classify different divisions for various industrial segments. We have never looked at it in Incap that way. We produce complex electronics, and the electronics can be used in medical, industrial, defence or other segments. If you swing a hammer on an electronic device, then inside, in principle, it’s the same. You will have some buttons, displays and some mechanical emballage around it and it doesn’t matter if it is, for instance a computer, a tester or a mobile phone. I don’t believe that there is very big difference in many of these segments. So, if you don’t talk about different commodities, perhaps the answer is that it’s rather a point of view than actual practical difference in the business.

Q: What are Incap’s long-term financial targets?

A: I still believe there’s a sweet spot and when EMS companies become big, they become very rigid. There is very big strength in our operational model and if we can continue to scale it up and be i.e. 500 million to a one billion company instead, while keeping the same way of working, then I think there’s a sweet spot on the market for that. Again, most bigger companies get very rigid and start dictating customers what they want. We often get customers from these bigger companies, and they are seeking more a service approach and a tailor-made approach. I think we can offer that by growing Incap as well. We continue to scale both organically and through M&A, which we pursue actively.

Q: Do you expect to finish any M&A transactions this year?

A: I expect to finish a lot of transactions every year, but it takes two to tango. We have an excellent team to do due to diligence and to look into different cases.

We may have done fewer acquisition acquisitions than some other, but we haven’t stepped on any mines either. Things take time and I’m not stressing it. We are earning money, we have a healthy business and the right time will come for acquisitions. Many of those acquisitions that some of our peers have communicated lately are very familiar for Incap as well. I’m always hopeful, but whether it will be this year or not, that I can’t say.

Incap is working very closely with an M&A team, and we have an established organization to do acquisitions. We have also external help if a case moves on to the due diligence phase. We have all the resources needed and the firepower to do acquisitions. We are constantly looking at different markets and working typically with several acquisition leads on parallel. There are always three to five leads, where we are meeting the owners, negotiating with the owners and making the valuation, doing the non-binding bids and so forth. We have a lot of activities ongoing at the moment as well. It’s always very difficult to say about the timing, as it depends on many factors: how the due diligence goes, if we find any red flags that are showstoppers and so forth. But the more you keep trying, eventually you will get a deal that is good for Incap and the shareholders of Incap.