Incap 3Q 2025: Questions and answers

Incap Q3 2025 webcast on 24 October 2025 at 14:00 EEST

Q: Incap’s guidance assumes a strong Q4. What gives you confidence that the target is achievable?

A: We are within the Q4 already and we know well what orders we have. So, we have quite high confidence when it comes to the outcome. Of course, something can always happen but it’s very unlikely that we wouldn’t hit our marks.

Q: Is the guidance based on already confirmed orders or is it more based on the signals about improving customer demand in the Q4?

A: It’s based on confirmed orders. When we talk about the running quarter then we are already talking about actual orders. As I’ve said before, in the period of three to six months we know quite well where we’re going because of the orders. In our business, material lead times often are as long as three months or sometimes even longer. So, we are very well aware of what we are going to do in the coming months, and this is production we have already planned a few months back. We just internally finished a quite extensive forecasting round in the beginning of October, and the feedback and the overview we received is very much supporting this statement on Q4.

Q: Can you comment about potential differences of revenue and profitability across the units or segments, and their development?

A: We normally don’t report those separately or comment in detail on segments or units. But, of course, there is always differences and variation between the different units depending on their customers.

Q: How would you comment on the demand situation across different geographical regions?

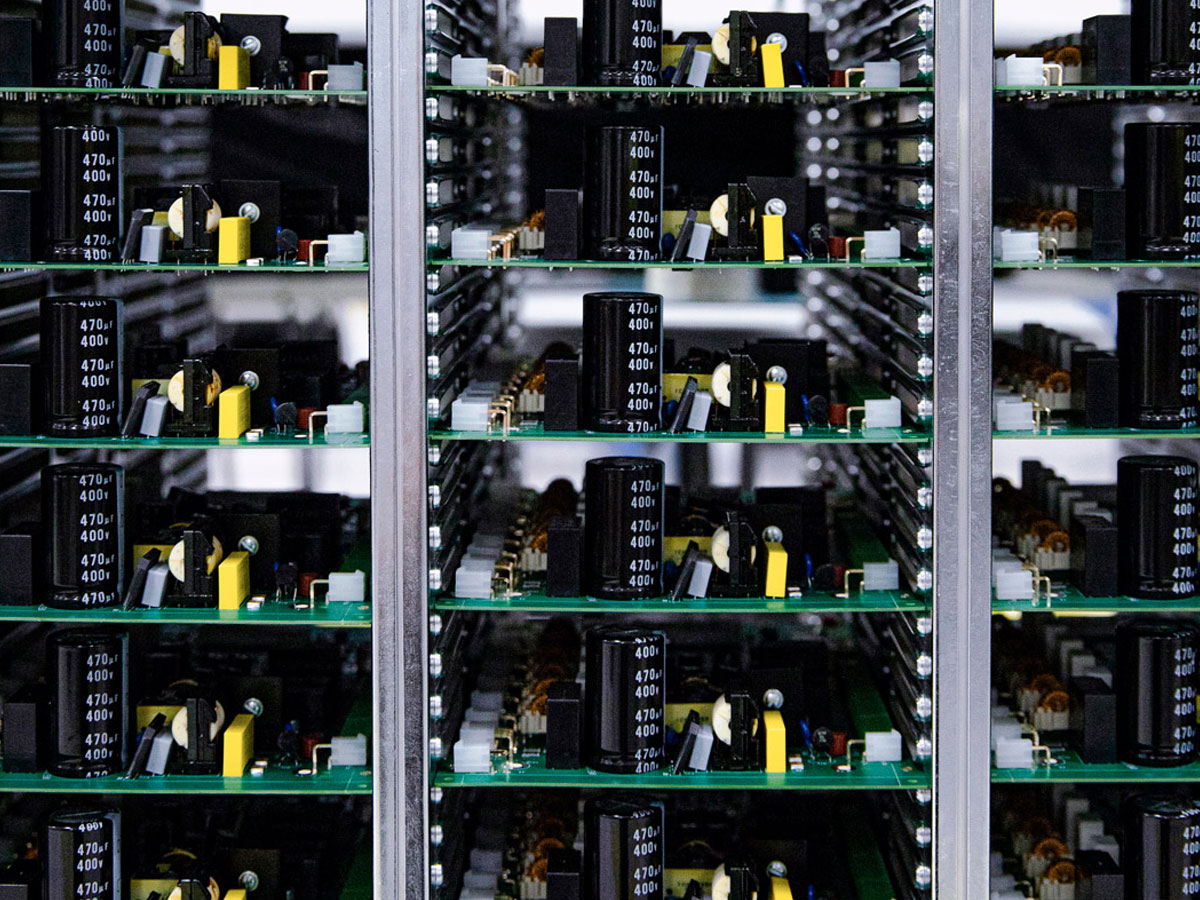

A: I think we still see some effect of the US tariffs and uncertainties from some regions. It also needs to be kept in mind that the trade deals are still not in place in all regions. That is still in the background of some of the plans and the demand situation. In general, we see some growth in defence and aerospace sector which we still have a quite small exposure to , even if it has grown over the years. There’s also increase in demand around the data centres and AI, and of course that infrastructure is normally taken by the bigger tier ones. But we see demand in projects around the infrastructure and there we are also active. The general market demand is quite flat what comes to classic industry, and we don’t see any huge increase in demand besides these two sectors where we see growth currently.

Q: What is the reason behind high financial expenses?

A: It’s a large number that we reported under financial expenses. Financial expenses consist of the unrealised currency rate effects, realised currency rate effects, leasing related financial expenses, and typical bank loan related interest expenses.

The whole amount of EUR 5.5 million is not only loan expenses paid to the banks, cumulatively we pay about EUR 700,000 for the loans in interest fees. The largest item is unrealized currency rate effects, totalling EUR 3.5 million. They relate mostly to internal foreign currency loans that we have granted to subsidiaries and then re-evaluated at the end of month. So, these fluctuations explain the majority of that part. Then smaller amounts are related to the leasing liability, amounting to some EUR 300,000. A bit over 10% was realized currency rate effects. So, the largest amount by far are the currency rate fluctuations and minority are the real financing fees.

Q: Could you explain the effect of the US dollar and the Indian rupee in more detail, and how it affects your top line?

A: Approximately one quarter of the revenue difference between this quarter and last year’s comparable quarter is explained by currency fluctuations. The units report their figures to the HQ, and we consolidate the values with the average rates and then compare them to the last year Q3 figures.

For example, Indian rupee has weakened quite dramatically against euro and there’s over 10% of fluctuation. We receive their figures in rupees as that is the functional currency of Indian entity and then we mathematically convert the figures to euros to consolidate the subsidiaries. So that is the explanation behind this impact.

In India we buy and sell mostly in US dollars which are then converted into rupees for the reporting which are then converted into euros. So, there’s a lot of mathematical exchanges that take place in the reporting. We have three large factories in India where business is mostly in US dollars and of course our US factory as well so the majority of the business in Incap is in US dollars and not in euros. In our UK unit we have of course British sterling, and it is converted into euros for the reporting.

Q: Are you planning to increase inventories in the coming quarters?

A: If the volumes go up then of course inventory goes up as well. That said we have been working on reducing inventories as we were overstocked some time ago. Also, material availability is better on the market and that means that inventory levels can be taken down as we don’t need to buffer up materials as much as in the past. Our current inventory level, which was a little bit higher than the previous one, is some kind of an indication of the volume level, but you can’t take it one-on-one because there are more factors in it.

Q: Can you comment on the volumes for your largest customer and how do they look going forward?

A: Our volumes to our largest customers are stable and we continue to serve them on a high level. That said, we have been working very much together with them to reduce the cost for their products and to find alternatives when it comes to different components that are cheaper. Of course, that takes down the product price even if we earn a percentage-wise the same money. If the bill of material cost goes down in the product, we will in absolute terms earn less. So, that has a little effect when looking at this year compared to earlier years. We are producing the same or even higher volumes, but we earn less because the work has been done with the product prices to get them optimised and cheaper. It’s part of our service and we try to help our customers to achieve their goals when it comes to cost levels.

Q: How much do you ship from India to the US and are you currently suffering from the higher tariffs from India?

A: The volumes going from India to US are about 20% so far this year. So, it hasn’t impacted so much directly, but India and US are still settling their trade and have not the trade agreement fully in place yet. So, let’s see how it ends up – but we continue to ship to US from India and will hopefully do it in the future as well.

Q: Are there any regulatory or structural challenges for you in getting a larger share of revenue from the defence sector?

A: There are no hurdles posed by law or regulations, and we’re working on increasing the defence segment as well. Defence sector companies are quite old and conservative. It takes time to qualify, and even if we have now qualified with several of these bigger defence giants, it still takes time before it becomes a vital part of our business. That said, in the newer defence segments like drones and other start-up companies in the industry, the hurdle is much lower, and there we have quicker developments. The defence industry is quite conservative, so it takes time. The defense market is still expected to go up and peak somewhere around 2030. So, I think the work we are doing will pay off.

Q: How much cross selling potential do you have from the US Pennatronics acquisition and how much of that potential has already been realized during the first two years you have been operating as one unit?

A: I think we have quite good development when it comes to cross selling opportunities, and we have several customers out that are or have been exploring the possibilities, and we also have some production started with them. When we did the Pennatronics acquisition, several of our customers realized that we are now more globally positioned, and they look into possibilities to take advantage of that. So, I think it has gone very well.

Q: You have a lot of cash on your balance sheet – what plans do you have with that? How is your M&A pipeline, and how do you see the valuation of the potential acquisition targets?

A: We naturally have plans for the use of cash. M&A market is currently more active, and we have a good pipeline. Incap is looking for different ways of growing through organic growth, which is something we explore very aggressively. On the other hand, we see also consolidation giving a lot of opportunities in the market through acquisitions. Recently, within the past three to six months’ period, there have also been bigger size acquisition targets, let’s say around EUR 100 million and even higher revenue companies, available. With the firepower and a very healthy balance sheet and cash position, we are of course keen to explore all the potential targets out there. Growing through acquisitions obviously needs a lot of cash, and it also helps to move quickly when the right target arises. In that sense, we are ready if there’s a good opportunity and the valuations and cultures match. So, we are looking and ready to move quickly in that field.

Q: How do you see the valuation has developed with a lot of market activity – has that driven the target valuations up?

A: I think we see somewhat higher expectations in that sense that there is more activity and also more competition for some of the targets.

Q: How do you see the alternative uses for the cash and buying back your own shares?

A: If we are not successful with the M&A’s, there will be possibilities with share buybacks and dividends, but that is more up for the Board of Directors. In the management we want to keep the money to have the possibility to make moves with it. From the management perspective, we also see that the bigger the company gets, the better possibilities it has of succeeding also in the future. When buying bigger quantities of materials, the company gets better prices and payment terms, and it will be more competitive in the market. This is why the management sees that we should invest in the business and grow it through different ways: both organic growth, investing in the lines and latest technology, and inorganic growth. To be a sustainable business ten years from now, it is key that the business is growing and staying competitive.